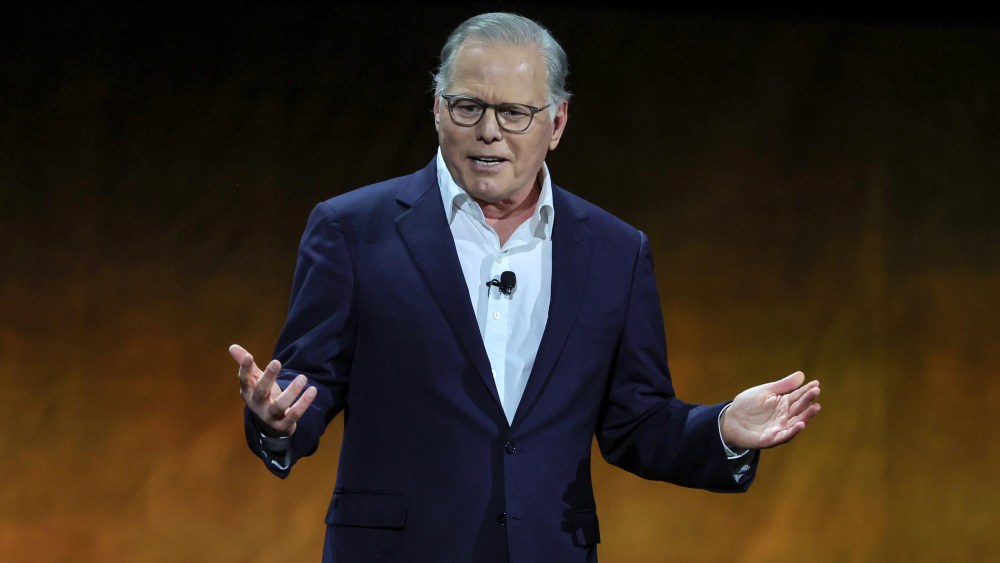

Four years ago, David Zaslav insisted that Discovery Communications together with what was then called WarnerMedia was more than the sum of its parts. They had a “formidable” lineup of global assets, he said.

“When you put us together — Batman, Superman, Wonder Woman, ‘Game of Thrones,’ ‘Sex and the City,’ HBO and Discovery being everywhere in the world with local content — we’re better together,” Zaslav said in 2021, explaining the logic behind combining Discovery and WarnerMedia (then owned by AT&T).

Fast-forward to today, and the math has changed. Zaslav has now reversed course, announcing that Warner Bros. Discovery will proceed to dismantle the agglomeration of different businesses he assembled under one roof. In short: That “formidable” combination has been weighed down by declining revenue, viewership and profits across WBD’s collection of linear TV portfolio.

As announced Monday, Warner Bros. Discovery will break apart like this: The Warner Bros. film and TV studio, HBO Max and Warner Bros.’ games and experiences division will be one discrete entity led by Zaslav. A new company will house CNN, TNT, TBS, Discovery, Food Network, HGTV and a raft of other channels with roots in linear cable in addition to Discovery+ and Bleacher Report. In something of a surprise, Zaslav is tapping his cost-cutting right-hand man, CFO Gunnar Wiedenfels, to head the yet-unnamed cable TV spin-off.

Wall Street seemed to like Zaslav’s decision, at least in the morning hours on Monday. WBD shares have been trading at under $10 since early April. Monday’s news drove a 7% spike out of the gate after closing at $9.82 on Friday — but since then, the price has drifted down and erased those gains, with the stock in negative territory.

To be sure, the issues buffeting the media and entertainment industry are larger than just WBD and Zaslav. In February, in Variety’s cover story on Comcast’s plan to spin off most of its NBCUniversal’s cable channels into a separately traded entity, we promised readers in a cover line: “It won’t be the last.” Warner Bros. Discovery proved us right early Monday with news that it will cleave the company into two parts.

Warner Bros. Discovery is motivated by the same pressures that led Comcast to be the first of the majors to take the leap in divesting their cable assets. Separating the Warner Bros. studio operations and HBO Max from linear cable channels will help shield those assets from cable’s problems. But it will also put more pressure on Warner Bros. film and TV arms to deliver the goods — and the profits.

The key takeaway: Media giants can move assets around their balance sheet — Warner Bros. Discovery, for one, has been in restructuring mode for three solid years — but at some point, the earnings math will catch up with them.

For Zaslav, there won’t be as much room to hide on earnings reports if the cable division’s cash flow is removed. For now, cable TV channels still generate the reliable cash flow that conglomerates like WBD and NBCU have come to rely on. Long-term, it’s a melting ice cube as advertising revenue and affiliate fees shrink in the coming years along with the subscriber base for traditional cable.

The cable untethering will come at a price for the industry, which is already feeling the pain of mass layoffs. The high-margin profit churned out for a solid 30 years (let’s call it 1985 to 2015) by cable channels was the primary engine of media and entertainment empire building. Streaming platforms à la HBO Max and NBCUniversal’s Peacock are growing but in no way positioned to deliver the dual-revenue stream dollars generated by USA Network, Syfy, E! and Oxygen when those NBCU channels were in their late-aughts prime.

When NBCUniversal first unveiled its spinoff plan in November 2024, Comcast leaders Brian Roberts and Michael Cavanagh emphasized that the standalone group of channels (the company has since adopted the moniker Versant) would have more flexibility to make acquisitions or be an acquisition target. There’s been chatter about a Great Roll-Up of linear cable channels on the theory that there might be buyers that would look to scoop up market share even in a declining sector.

But if there’s a wave of momentum for such cable TV deals, Wall Street and bankers have been hiding it well. It may well be that M&A activity that would otherwise be going on has been scared off for now by the macroeconomic turbulence spurred by President Trump’s aggressive moves with tariffs and other policy moves.

Zaslav has spent most of his career in cable TV land. After joining NBC in 1989, he helped develop and launch CNBC and MSNBC. He moved to Discovery in 2006. Now, Zaslav has decided that WBD’s future lies in streaming and HBO, along with the production studios that pump TV shows and movies into the streaming ecosystem. And Zaslav is putting the old-fashioned cable channels on their own life raft to sink or swim on their own.

Read the full article here